Balance Sheet Example Template Format Analysis Explanation

Leave a Comment

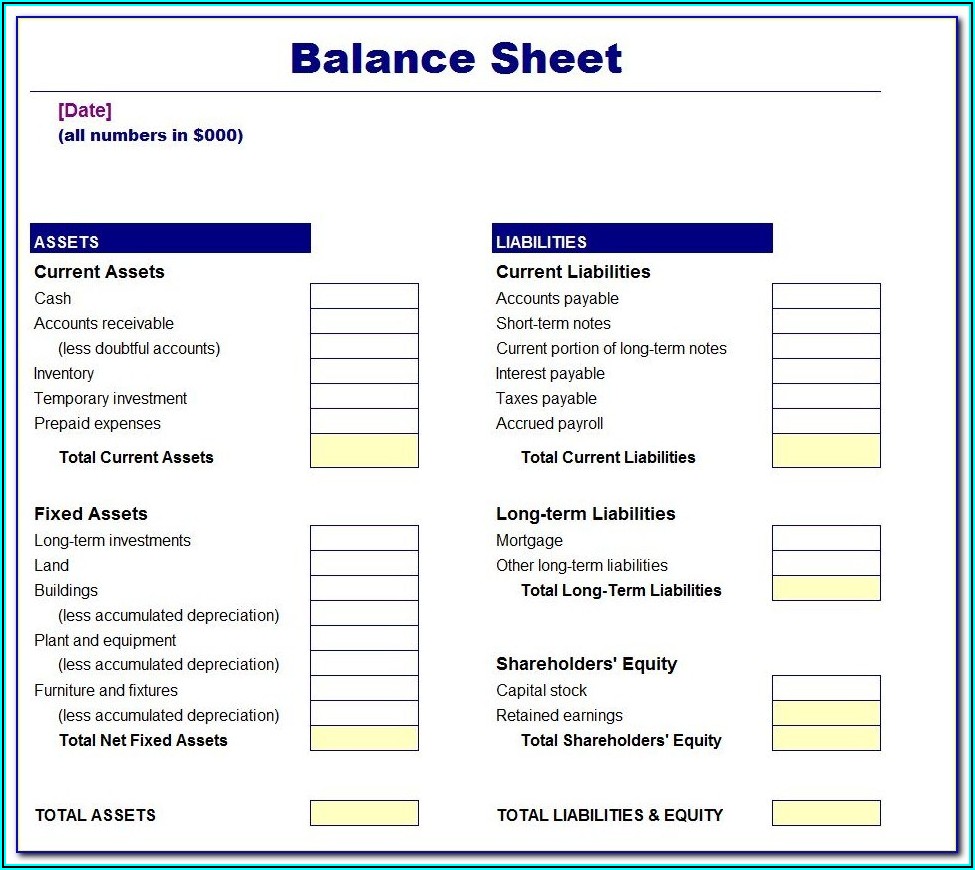

You can use this report to see how your business is doing overall and whether it has enough cash to cover its expenses. Additionally, balance sheet templates allow you to enter projected figures so that you can compare your current financial standing with your projected or target finances. For example, you can use a balance sheet to determine what your quarterly figures must be in order to beat your previous year’s profits. Track your quarterly financial position by entering each month’s assets and liabilities and reviewing the monthly and quarterly perspectives of your owner’s equity. Monthly columns provide you with assets, liabilities, and equity tallies, and also reflect three-month figures for each quarter. This is the perfect template for short-term analysis of fiscal health but can be used for year-over-year monthly and quarterly comparisons.

Gain Insight into Your Company’s Financial Position with Balance Sheets in Smartsheet

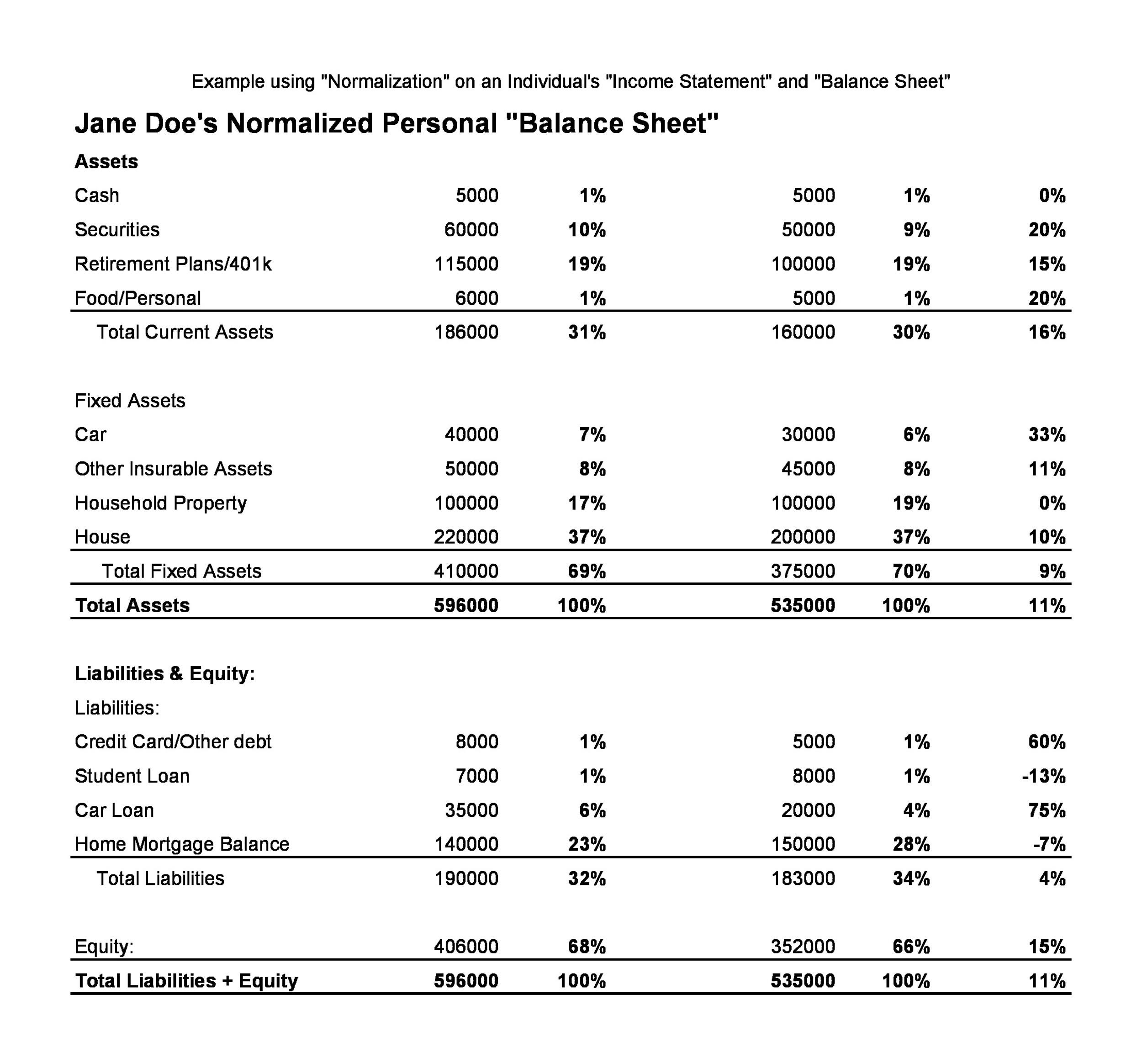

As opposed to an income statement which reports financial information over a period of time, a balance sheet is used to determine the health of a company on a specific day. A company usually must provide a balance sheet to a lender in order to secure a business loan. A company must also usually provide a balance sheet to private investors when attempting to secure private equity funding. In both cases, the external party wants to assess the financial health of a company, the creditworthiness of the business, and whether the company will be able to repay its short-term debts. If a company takes out a five-year, $4,000 loan from a bank, its assets (specifically, the cash account) will increase by $4,000. Its liabilities (specifically, the long-term debt account) will also increase by $4,000, balancing the two sides of the equation.

Easy Balance Sheet Examples of Small Businesses

Balance sheets are used to determine if a company can meet its debt obligations, while income statements gauge profitability. The balance sheet includes information about a company’s assets and liabilities. Depending on the company, this might include short-term assets, such as cash and accounts receivable, or long-term assets such as property, plant, and equipment (PP&E).

How often are balance sheets required?

Balance sheets are important for determining the financial health and position of your business at a certain point in time. When used with other financial statements and reports (such as your cash flow statement), it can be used to better understand the relationships between your accounts. A balance sheet is one of the most essential tools in your arsenal of financial reports.

Add Total Liabilities to Total Shareholders’ Equity and Compare to Assets

You can easily factor in property costs, expenses, rental and taxable income, selling costs, and capital gains. Also factor in assumptions, such as years you plan to stay invested in the property, and actual or projected value increase. You can also edit the template to include whatever details you need to provide for renting, refinancing, home-equity lines, and possible eventual sale of your investment property.

It may not provide a full snapshot of the financial health of a company without data from other financial statements. Examples of activity ratios are inventory turnover ratio, total assets turnover ratio, fixed assets turnover ratio, and accounts receivables turnover ratio. It is crucial to remember that some ratios will require information from more than one financial statement, such as from the income statement and the balance sheet.

When the balance sheet is completed and the starting and ending cash balances that are calculated, the Cash Flow Statement is the next financial statement to tackle. If you are using double-entry accounting software, a company balance sheet is very easy to create. You can also run a comparison between two dates to compare your current accounting balance sheet with a previous accounting period.

- It’s important to note that how a balance sheet is formatted differs depending on where an organization is based.

- Completing the form will provide you with an accurate picture of your finances.

- Use this simple, easy-to-complete balance sheet template to determine your overall financial outlook.

- By comparing these three fundamental elements, businesses can assess their financial stability and make informed decisions.

- A balance sheet shows only what a company owns (and owes) on a specific date by displaying assets, liabilities, and equities.

- These operating cycles can include receivables, payables, and inventory.

Balance sheets allow the user to get an at-a-glance view of the assets and liabilities of the company. Employees usually prefer knowing their jobs are secure and that the company they are working for is in good health. When analyzed over time or comparatively against competing companies, managers can better understand ways to improve the financial health of a company. The current ratio measures the liquidity of your company—how much of it can be converted to cash, and used to pay down liabilities. The higher the ratio, the better your financial health in terms of liquidity.

Assets describe resources with economic value that can be sold for money or have the potential to provide monetary benefits someday in the future. Angela is certified in Xero, QuickBooks, and FreeAgent accounting software. To simplify bookkeeping, she created lots of easy-to-use Excel bookkeeping templates. The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, tax calculator return and refund estimator 2020 helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed. For additional tips and resources for your organization’s financial planning, see our comprehensive collection of free financial templates for business plans.