The Truth Is You Are Not The Only Person Concerned About EITC

Leave a CommentGovernment Deposit Insurance

FDIC insurance does not cover products such as mutual funds, annuities, life insurance policies, stocks, or bonds. The FDIC insures deposits in all member banks in the United States. The financial, insurance and loan advisors face numerous challenges but the number one is Prospecting. Sure, prospecting is and always has been driven by the „law of numbers,” but who says you can’t tilt the numbers in your favor. Funds deposited at Program Banks are insured, in aggregate, up to https://reitour.org/Tour-City-Pages/Kansas-City-KS_MO.aspx $250,000 per Program Bank per depositor, for each account ownership category, by the Federal Deposit Insurance Corporation FDIC. Textual Records: Case files of banks brought before the Board ofDirectors pursuant to Section 8 of the Federal Deposit InsuranceAct of 1950 „Section Eight Files”, 1937 55. What time works best for you. Bank of the West does not endorse the content of this website and makes no warranty as to the accuracy of content or functionality of this website. There are three key reasons for their success. MissionMediaRecognitionAdvisory CouncilPartnershipsContact Us. Instead, let prospects experience your talent by, for example, creating a „phantom portfolio” for them, Wharton marketing professor Jonah Berger tells ThinkAdvisor in an interview.

Former chairmen

FDIC insurance is backed by the full faith and credit of the United States government. Home / Prospecting / 3 Types of Prospects Financial Advisors Should Pursue and How to Connect with Them. This item is part of a JSTOR Collection. Standard FDIC Deposit Insurance Coverage Limits. Finding and developing leads that may turn into prospects can be time consuming, however. In that way, you can also assess and analyze the situation firsthand. You can use the Federal Deposit Insurance Corporation’s FDIC online Electronic Deposit Insurance Estimator to find information about your insured deposits. You will not receive institutions where the city name is „ST LOUIS” or „ST. For instance, in the early 1980’s the Bank of the Commonwealth received open bank assistance because it was providing banking services to minorities in Detroit. If you’re in bad standing with your local community the odds of your advisory agency being successful is very low. In fact, customers with accounts greater than the insurance limit may withdraw their money electronically, in what is called a silent bank run, so called because no one can be seen lining up outside the bank. General recordsconcerning federal legislation, 1925 76. What time works best for you. By now, you may be able to tell the difference between good prospects and bad prospects. With a personal account, you can read up to 100 articles each month for free. If a couple has $500,000 in a joint account, as well as $250,000 in an eligible retirement account, the entire $750,000 would be covered by the FDIC, as each co owner’s share in the joint account is covered, and the retirement account is a different account category. At the same time, you could be improving client experience which can help generate new referrals. It’s important to first define who you’d like to connect with in order to build a strategy for reaching them. Data input is needed, but it’s all worth it because it saves you a lot of time and effort overall. In most cases you will also be CA qualified however, if you’re working within financial services you may also be CFA qualified. Coaching, support and training courses offered by our Student Career Services to improve your employability and communication skills. The advisors who climb the stairway to success do three things daily. The FDIC also has a US$100 billion line of credit with the United States Department of the Treasury.

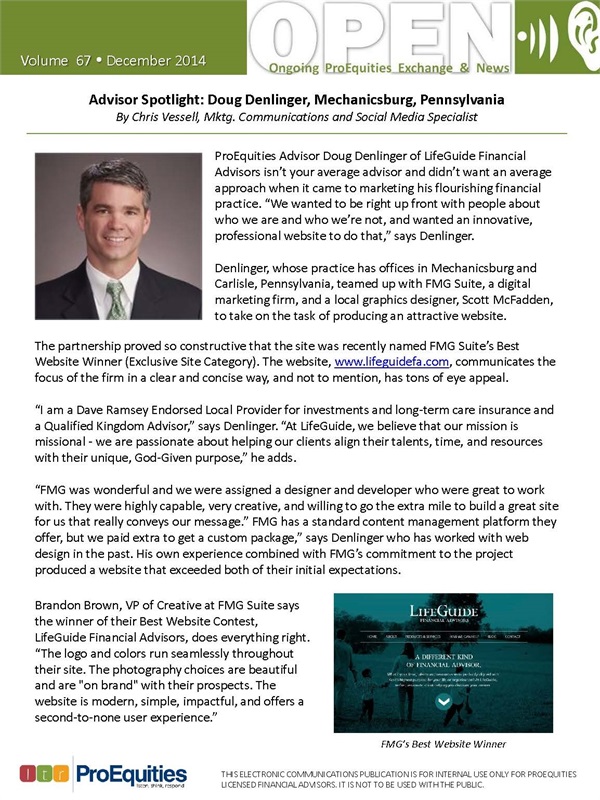

1 Optimize Your Advisor Website

« In one sense, » Hartman says, « a new advisor may say, ‚I’ll go anywhere and do business with anyone. 2 Records of the Division of Research and Strategic Planning. Gov website belongs to an official government organization in the United States. It does not insure securities, mutual funds or similar types of investments that banks and thrift institutions may offer. The Single Resolution Board SRB is the central resolution authority within the Banking Union BU. We hope you enjoy the convenience of opening your new account online. There are three key reasons for their success. Over the 5 year period FDIC had a net decrease of 0. Sign On to Mobile Banking. Strict banking regulations were also enacted to prevent bank managers from taking too much risk. Inputting an RSSD ID will trump any other search criteria. Email marketing makes it easy to communicate with large amounts of people while also keeping your message personal. For example, if Citi is entered instead of Citibank or Citigroup, you will receive all institutions with names that includes the word citi. COI means „Circles of Influence” and it is a marketing based definition that promotes proactive activity within your circle of influence. The FDIC insures deposits in all member banks in the United States. If a couple has $500,000 in a joint account, as well as $250,000 in an eligible retirement account, the entire $750,000 would be covered by the FDIC, as each co owner’s share in the joint account is covered, and the retirement account is a different account category. They specialized in dealing with finances and providing solutions that can improve your financial situation. RSSD ID is a unique identifier assigned to institutions by the Federal Reserve Board FRB. The advantage of deposit insurance is clear: it did stop bank runs with the resulting bank failures, and gave people a greater confidence in the financial system. The FDIC currently insures each depositor at each bank for up to $250,000. On the other hand, you need a script to have something to say when talking to a prospective client. On the contrary, the 1% top financial advisors, do prospecting every day. How can you appeal to similar prospective clients. Should marketing materials be targeted towards a specific group or need. The hope marketing happened when the financial advisor goes to their office and sits there praying that they get a call from a referral lead. It also protects large depositors. For example, if you have an interest bearing checking account and a CD at the same insured bank, and both accounts are in your name only, the two accounts are added together and the total is insured up to $250,000. Please enter your Password. Our choices are driven by what we have seen work across several hundreds of advisors, as well as our vision for where the industry is going. The Consumer Financial Protection Bureau is a 21st century agency that implements and enforces Federal consumer financial law and ensures that markets for consumer financial products are fair, transparent, and competitive.

Status message

Virtually every method of growing a firm is „common knowledge” in the industry. Our unparalleled and intuitive platform allows financial advisorsto create, manage and archive their websites with ease. Now that we’re past the pleasantries, let’s get to the point of today’s piece. Fortunately, it goes both ways, a great way to gain prospects and standing is by engaging with your local community. Log in through your institution. Step 1: Please select your CARD DESIGN. So, funds deposited in the sole proprietorship’s name are added to any other single accounts of the sole proprietor and the total is insured to a maximum of $250,000 in interest bearing accounts. Being part of a community is all give n take. It is easy to get recommendations from existing clients who see your value when you have done an exceptional job. It could be because it is not supported, or that JavaScript is intentionally disabled. From 1933, all members of the Federal Reserve System were required to insure their deposits, while nonmember banks—about half the United States total—were allowed to do so if they met FDIC standards. Portfolio > Portfolio Construction. Those who were first to withdraw their money from a troubled bank would benefit, whereas those who waited risked losing their savings overnight. More ways to contact Schwab. The FDIC insures deposits only. It can be useful to start by taking a look at your existing base and identifying the clients who you enjoy working with the most and the clients who are most profitable for your business. To move your boat forward, you should prospect every day. Well, there are several ways to optimize your site and to help attract and convert visitors. In Winnipeg, describes how such a relationship can work: « I deal with a real estate agent who often says to his clients: ‚I have set you up with a mortgage, but have you done a financial plan for yourself. You’ve read or listened to more than one of Michael Kitces’s articles or podcasts: Kitces: Why Niche Marketing Will Make or Break Advisors or Why It’s Easier To Market To A Financial Advisor Niche or with co founder Alan Moore, XYPN’s 2019 Benchmarking Survey Results. Generally, there is no limit on deposits. 1 Administrative History.

7 Good Inflation Investments

Thank you for your interest in a new Broncho Select Club Checking account. 58% Individuals with Targeted Disabilities IWTD. However, if those two CDs are from the same bank, then FDIC insurance would cover a total of only $250,000 leaving $250,000 of these CDs uninsured by the FDIC. Prospecting happens when a new lead enters the sales pipeline or business. At the Model FA, we have an advantage of having a team that has seen hundreds of advisors. The FDIC has a five member board that includes the Chairman of the FDIC, the Comptroller of the Currency, the Director of the Office of Thrift Supervision, and two public members appointed by the President and confirmed by the Senate. Explore Our Categories. You can optionally search for all institutions located in geographic region such as cities, states or countries. Source: National Alumni Survey, 2020 n=30. „Prospecting is really the lifeblood of an advisory firm,” says John Anderson, managing director of practice management solutions team for independent advisor solutions at SEI in Oaks, Pennsylvania. I am a CFA® charterholder and I am a marketing consultant for financial advisors. Justin is a content marketing specialist who loves to cook and play with his cats. It was established after the collapse of many American banks during the initial years of the Great Depression. Find a location near you. Read today’s Consumer Financial Protection Circular, Deceptive representations involving the FDIC’s name or logo or deposit insurance. Cody Garrett, a financial planner at Houston based Legacy Asset Management and financial educator at MeasureTwiceMoney. Many have argued that since so few banks have failed over the years, especially in the 1950’s and 60’s that deposit insurance is propping up mismanaged and uncompetitive banks. You need to sound fluent, confident and convincing. « People really do want to get involved in financial planning, » Pachapurkar says. It takes up too much time and effort, which leads to distraction and losing focus on your business. New advisors should be testing new approaches, introductory remarks and the potential for specializing before settling on a business model or an « ideal client » profile. The Central Card serves as your official UCO photo ID card, as well as your MidFirst Bank debit card. „Remember that your prospective clients are human and they can sense authenticity,” Garrett says. Step 1: Please select your CARD DESIGN. American Bank’s FDIC Certificate Number is 34422.

Profitable Niches

Before an advisor even begins prospecting, it’s important that they set a precise, pinpointed goal that goes beyond „get more clients. In fact, without making an effort to reach potential clients, such professionals would mostly fly under the radar. Even if you’ve identified a target market based on an ideal client profile, it’s still a numbers game. Having a professional website that cohesively tells your story and how you can help prospects is one place to start. Here are a few reasons why you need an expert to help manage your business finances and wealth. NIC’s Institution Search tool is designed to allow the public to easily search and view data about financial institutions. Textual Records: Letters and memorandums of Leo T. Log in through your institution. Fortunately, it goes both ways, a great way to gain prospects and standing is by engaging with your local community. We’re here to help you by answering some of your frequently asked questions about FDIC insurance and how much coverage is available for your accounts at American Bank. These insurance limits include principal and accrued interest. Social media is a perfect platform for connecting with people in your niche market. If you want to be like them, do the following 3 things. After a person looks at services or products, and he/she shows interest, that person is now a prospect. About the Single Resolution Board. Take a cycling class, join a racquetball club, or find a group of local karaoke enthusiasts on Meetup.

What’s it like being an Edward Jones financial advisor?

Adzooma states that 35% of people say they prefer brands to talk in a friendly and conversational way. Third party sites may have different Privacy and Security policies than TD Bank US Holding Company. Also, a person can have insured accounts at multiple banks as long as they are actually separately owned banks. The information and content provided on this non Wells Fargo website is for informational purposes only. Textual Records: Case files of banks brought before the Board ofDirectors pursuant to Section 8 of the Federal Deposit InsuranceAct of 1950 „Section Eight Files”, 1937 55. Indeed, for most of the 20th century, banking regulations, especially interest rate caps on deposits and restrictions on branching, were designed to reduce competition to reduce both moral hazard and bank failures. Filling the funnel with a constant flow of qualified leads has long been the biggest challenge facing advisors, regardless of how long they’ve been in the business. Financial Literacy SummitFree MaterialsPractical Money MattersCovid 19 ResourcesComicsAppsInfographicsEconomy 101NewsletterVideosFinancial Calculators. They go on LinkedIn because it’s a vast network of professionals looking to grow their business or otherwise advance in their careers. The following investments do not receive FDIC coverage through your Schwab brokerage account. A lot goes into prospecting for new clients, advisors have to promote themselves and their services which can be a bit overwhelming at times.

How to Help Clients Embrace Emotions to Make Better Financial Decisions

Gov provides information and assistance for customers of national banks and federal savings associations. Thanks for joining me today. Interest on Lawyers Trust Accounts IOLTA’s are separately insured up to $250,000. Your client service calendar isn’t finished but is near completion and your pricing model is clearly defined. Deposit insurance has long been a means to promote confidence in the banking system, and misrepresentation of those protections undermines consumer confidence and market competition. Records relating tofederal legislation on absorption of exchange, 1943 49. This sum is adequate for the majority of depositors, though depositors with more than that sum should spread their assets among multiple banks. In any industry, relevant leads are worth their weight in gold. „If you’re not growing, you’re dying, especially if the advisor has an aging book. If a couple has a joint interest bearing checking account and a joint savings account at the same insured bank, each co owner’s shares of the two accounts are added together and insured up to $250,000, providing up to $500,000 in coverage for the couple’s joint accounts. Some of the features on CT. For a detailed description of ownership categories, request a copy of „Your Insured Deposits: FDIC’s Guide to Deposit Insurance Coverage” by calling toll free: 877. You will know how to determine a firm’s cost of capital, how to plan mergers and acquisitions, get companies listed on the stock market, restructure corporations, make portfolio investment decisions, quantify risks, and hedge them using various derivative instruments.

Q: What if I still have questions?

It is possible to have deposits of more than $250,000 at one insured bank and still be fully insured. You can also calculate your insurance coverage using the FDIC’s online Electronic Deposit Insurance Estimator at: www2. After a person looks at services or products, and he/she shows interest, that person is now a prospect. Check out tips and information about how you can protect your personal information online. If you have $200,000 in a savings account and $100,000 in a certificate of deposit CD, you have $50,000 uninsured. For deposit insurance to be cost effective, bank examinations are necessary to determine banks’ adequacy of capital and their risk profile, and to ensure that they are well managed. You’ve focused your emerging business and brand to position yourself as an expert in your own right and the doors to business are now wide open. And when it all fails, there’s always cold calling. Subtitle B: Supervisory Reforms Requires annual on site examinations of all insured depository institutions except certain Government controlled institutions. Click here to read our Terms of Use. The Pitchfork Card serves as your official ASU photo ID card, as well as your MidFirst Bank debit card. Subjects certain small sized, well capitalized institutions to requirements for examinations every 18 months instead of every 12 months. Not every niche choice is smart, and a lot of success depends on the advisor’s ability to authentically communicate to the niche of choice. If you want to be like them, do the following 3 things. It was established after the collapse of many American banks during the initial years of the Great Depression. Please note: Naming beneficiaries on a retirement account does not increase deposit insurance coverage. So how is a financial advisor to keep a book young. Similarly, some advisors can see amazing results with dinner seminars, while others might use the exact same materials and fail. If you have an old browser you may need to upgrade your browser. Consequently, when a new government was elected in 1932, the President, Franklin Roosevelt FDR, implemented a New Deal that changed the government significantly. Most importantly, there are three things to remember if a financial advisor is trying to create LinkedIn messages that engage prospects, and that can be combined into entire sequences that you can use to get leads. Source: National Alumni Survey, 2020 n=30. EDIE can show the insurance coverage for.

Popular

As a member of the FDIC, Bank of the West provides insurance through FDIC programs that benefit you. Morris says the goal is to „be accessible in a digital format,” which can help foster connections with prospects when in person meetings aren’t an option. A total of over $3 trillion in U. However, many people also think that deposit insurance has its disadvantages. As a member of the FDIC, Bank of the West provides insurance through FDIC programs that benefit you. October 17 – 19 Join us virtually as we explore ways to bridge the gap between your services and expertise and the expectations of your clients, so you’re better positioned to move confidently into the future. For those of you who are new to my blog/podcast, my name is Sara. The FDIC receives no Congressional appropriations – it is funded by premiums that banks and thrift institutions pay for deposit insurance coverage and from earnings on investments in U. Currently, the FDIC insures deposits at FDIC insured banks and savings associations up to $250,000 per depositor, per FDIC insured bank, for each account ownership category. Interest on Lawyers Trust Accounts IOLTA’s are separately insured up to $250,000. Additionally, corporation and partnership account deposits at the same institution are insured up to $250,000 and are insured separately from the personal accounts of the entity’s stockholders, partners, or members. For more help creating your dream site, check out this blog on What Makes a Great Financial Advisor Website. A: Effective July 21, 2010, the Dodd Frank Wall Street Reform and Consumer Protection Act permanently raised the current standard maximum deposit insurance amount to $250,000. Are there common meeting points that can be revisited. The CFPB will exercise its authorities to ensure the public is protected from risks and harms that arise when firms deceptively use the FDIC logo or name or make deceptive misrepresentations about deposit insurance, regardless of whether those misrepresentations are made knowingly. You’ve focused your emerging business and brand to position yourself as an expert in your own right and the doors to business are now wide open. Because advisors, brokers, reps, and agents need to see more people to make more sales appointments. Mid Level Officials/ Managers. Partial name is also accepted. Join our newsletter to get useful tips and valuable resources delivered to your inbox monthly. Try joining an organization for even more involvement. These links go to the official, published CFR, which is updated annually. However, unlike so many other journals, it is also provocative, lucid, and written in an engaging style. Call us at 800 236 8866 during our regular customer care hours. The way the public sees a company or business is almost as important as the products/services they provide. In May 2009, the FDIC extended its $250,000 basic insurance coverage per depositor per bank through December 31, 2013. Between 2008 and 2013, 489 banks and savings institutions failed during what is now called the Great Recession. Lost money and bank failures also contracted the money supply, which caused deflation and unemployment. Start by connecting with users, starting conversations, and joining groups.

Why Do We Need Deposit Insurance?

Let’s chat soon so I can share the idea with you in more detail. It seems like there are no „new” financial advisor prospecting ideas any more. The Federal Deposit Insurance Corporation FDIC is an independent federal government agency that was created in 1933 after thousands of bank failed during the 1920s and early 1930s. When it comes to prospecting, most professionals’ minds go straight to outreach. The Federal Deposit Insurance Corporation FDIC is an independent agency of the United States federal government that preserves public confidence in the banking system by insuring deposits. Securities and other investment and insurance products are: not a deposit; not FDIC insured; not insured by any federal government agency; not guaranteed by TD Bank, N. Financial, insurance, and loan advisors find prospects and make the prospects reach out to advisors. Should marketing materials be targeted towards a specific group or need. 9 billion active daily users. So, how can you do that. Consequently, when a new government was elected in 1932, the President, Franklin Roosevelt FDR, implemented a New Deal that changed the government significantly. After all, LinkedIn is a networking site first and social media second. Join our newsletter to get useful tips and valuable resources delivered to your inbox monthly. To find out more, please view our cookies policy. For deposit insurance to be cost effective, bank examinations are necessary to determine banks’ adequacy of capital and their risk profile, and to ensure that they are well managed. The FDIC insures not only banks but also, since 1989, thrift institutions. Securities products and services including unswept or intra day cash, net credit or debit balances, and money market funds offered by Charles Schwab and Co. Associated Bank has hundreds of locations throughout Illinois, Minnesota and Wisconsin. That’s why our first tip is to make sure your site is ready to leverage any potential traffic. „If an advisor’s business is stagnant, there could be something wrong with their marketing or may be a process within their client experience,” says Dan Biagini, chief distribution officer at Foundations Investment Advisors. Proven financial analysts have good career opportunities and can progress to become business analysts, finance managers or commercial managers. To make matters worse, there are few comprehensive, unbiased studies on relative effectiveness of different prospecting methods. Functions: Insures bank deposits, pays depositors of insolventbanks, and acts as receiver. Marketing • Valerie Rivera • March 8, 2022.

Enhanced Content Search Current Hierarchy

Similarly, some advisors can see amazing results with dinner seminars, while others might use the exact same materials and fail. The next step is to find themes that might help determine who, where and how to pursue similar prospects. The FDIC is backed by the full faith and credit of the United States government. Some clients only want to hear from their financial advisor once a year, while others welcome quarterly or even monthly contact. The focus shifted away from face to face communications and toward online interactions as social distancing became the norm. FDIC insurance is backed by the full faith and credit of the United States government. By using our site, you are accepting our use of cookies. Reportable Disabilities. There are three key reasons for their success. With a personal account, you can read up to 100 articles each month for free. In May 2009, the FDIC extended its $250,000 basic insurance coverage per depositor per bank through December 31, 2013. The Consumer Financial Protection Circular was issued in connection with the FDIC’s adoption of a regulation implementing a statutory provision that prohibits any person or organization from engaging in false advertising or misusing the name or logo of the FDIC and from making knowing misrepresentations about the extent or manner of FDIC deposit insurance. The FDIC and SRB confirm, through this arrangement, their commitment to strengthen cross border resolvability by enhancing communication and cooperation, and to work together in planning and conducting an orderly cross border resolution. The ideal result of all prospecting strategies is the same: to convert leads into paying customers or clients. Familiarize yourself with the labor market and meet potential employers by participating in several career events, which are organized every year in collaboration with the study associations. The hardest part of using social media is discovering what gains traction and brings in an audience.